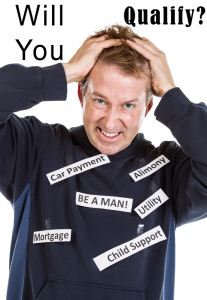

Will I Qualify for a Mortgage Loan Modification?

Will I Qualify for a Mortgage Loan Modification?

Applying for a mortgage loan modification is much like applying for a general mortgage. Factors for the lender to consider in a loan modification will include income and the likelihood that it will continue, as well as how much equity you have in the property.

Primary Residence

Getting a loan modification on a primary residence, which is the property where the borrower lives as their main home, is usually much easier than getting one on an investment property.

As a rule, lenders are more conservative with investment properties than with homes that borrowers live in. This reason is because if a landlord is dependent on renters for the income to cover the mortgage payments, the fact is renters may pack up and leave at the end of their lease, sometimes earlier. The renters have no attachment to the property.

However homeowners usually have an emotional attachment to their property, and usually do what they can to keep it. Additionally, knowing that a foreclosure could disqualify them from buying another home for the next four to five years gives them more incentive to want to keep their home, or at a least get out from under the mortgage without going through a foreclosure.

Financial Hardship or Distress

Borrowers, for a variety of reasons, may find themselves in financial hardship, causing them to be unable to pay their mortgage every month. Loss of income or unexpected expenses are generally the culprits, and may legitimately result from job loss, business difficulties, a divorce or a medical situation, among causes.

Lenders understand that this stuff happens, but they want to know how a borrower is going to move forward from the hardship and into a position to be able to make payments once the mortgage is modified.

Write a hardship letter to the lender at the beginning of the process, and include it in the modification application package to both help save time for overworked lender employees, and clarify where you, the borrower has been, and where you are headed.

Read more: Financing Help for Low-Moderate Income Buyers, Distressed Borrowers and First Time Buyers

Schedule a Consultation

Unable to Refinance Mortgage

Refinancing into a lower interest rate or better terms is usually the preferred option for borrowers who are looking to lower their mortgage costs. A loan modification is typically the choice for those who can’t refinance, or whose mortgage already offers attractive terms but need some temporary “breathing room” to get through a financial hardship.

However, because a refinance needs good credit , borrowers who expect possible financial stresses down the road should begin to explore a refinance immediately, rather than wait for trouble to arrive. A borrower who has begun to miss or be late on mortgage payments will likely face challenges in trying to refinance, due to a damaged credit rating, and might find that a loan modification is their sole option at that point.

Debt-to-Income Ratio

One of the main factors a lender takes into consideration for loan modifications is the borrower’s debt-to-income ratio. This is the ratio of gross monthly income (before taxes) to total mortgage payment. Lenders vary in the maximum debt ratios they’ll accept, but are generally in the 36 percent to 45 percent range. Compensating factors such as credit score, and the amount of equity in the property will lend to the decision that the lender makes in determining if a borrower should get a loan modification.

Considering the above, will you qualify? If you’re still not sure, contact us today!